Labor or social insurance systems

Upon establishing a business, the owner will be required to join a labor insurance or social insurance system. It is important to understand the different systems explained below as basic knowledge.

<Table Notification for labor insurance/social insurance>

| Type | category | Overview | Business category | Governnmental agency |

| Social Insurance | National Health Insurance | Covers part of medical fees for injuries and illness that happened outside of work | Personal Business Owner | Municipalities |

| National Pension Insurance | Generally paid to people over 65 years. | |||

| Health Insurance | Same as National Health Insurance | Mainly Corporations | Pension Office | |

| Employees Pension Insurance | Same as National Pension | |||

| Labor Insurance | Worker’s Accident Compensation Insurance | Compensations for injuries/illness incured as a result of work or while commuting to work | Common | Labor Standard Inspection Office |

| Employment Insurance | Compensation paid to workers who have lost their jobs. Can also be used to pay for workers training and acquisition of new skills. | Job-placement office |

※For purpose of easier comprehension, details have been omitted. In reality, criteria might change with the legislation in place, so you should consult the institution in charge or a specialist on the matter (Labor and Social Security Attorney)

Procedures after establishment of Company

After finishing the establishment procedures, there are few notifications related to labor insurance (Accident Compensation Insurance, Employment Insurance) and social insurance ( Health Insurance, Pension Insurance) that needs to be submitted at the Labor Standard Inspection office, the Job Placement Centre and the Pension Office. If you are applicable for labor/social insurance, joining them is mandatory.

Keep in mind that although private businesses qualify for health insurance and pension insurance, it does not cover the owner’s insurance, and he is required to separately join the National Health Insurance and the National Pension insurance. In this case, his family members are also applicable for paying the insurance fees (they are not exempted). There are many variations such as cases where an employment-based Health insurance system is designed for specific industries, so make sure you consult with your municipal office or a labor and social security attorney on this matter.

<Labor/Social Insurance Notifications >

| Where to apply | Name of the document | Content | Application deadline |

| Labor Standard Inspection Office | Notification of Establishment of a Labor Insurance relationship | Report that a relationship of labor insurance has between upon hiring an employee (mandatory when hiring workers) | Within 10 days from the day after establishment of the relationship (hiring day) |

| Tax return for estimated insurance premium for labor insurance | Paid according to an estimate of that year’s accident insurance and employee’s insurance | Within 50 days from the day after establishment of the relationship. | |

| Job Centre

(Employment Office) |

Notice of establishment of a covered enterprise | Report that your company is now applicable for employment insurance ( a company that employs workers eligible for employment insurance) | Within 10 days from the after becoming a covered enterprise (hiring a worker eligible for employment insurance) |

| Notice of acquisition of insured status | Report necessary to hire a worker eligible for employment insurance | By the 10th of the month following the month you hired the covered employee | |

| National Pension Office | Notice of establishment of health insurance/pension insurance relationship | Report that your company is now applicable for health/pension insurance

・Corporation:mandatory for all ・Private :Mandatory if employs more than 5 workers, free of choice if less。 |

Within 5 days of becoming an applicable corporation |

| Notice of acquisition of insured status | Required in order to give the applicable representative/employees health/labor insurance | Within 5 days of hiring the applicable employee. | |

| Notice of non-working dependents covered by health/labor insurance | Required if any of the employees has family members that qualify as dependents. | Within 5 days after the applicable employee has been designated as the provider. | |

| Notification of establishment of a relationship of insurance in the third grade by the national pension plan | Report that there is an employee spouse applicable for insurance in the third grade of the national pension plan. | Within 14 days after the employee has been designated as provider. |

Ordinary Tasks

1) Managing your employees working hours(Attendance Management)

If you hired employees, you need to verify daily their check in times, check out times and break hours. The most common tool used for this is a time record card. These records will serve as basis for calculating their salaries.

Furthermore, you need to prevent excessive overtime work, and for those who work too much, pay special attention to their health by making them take longer than usual breaks, sending them to the doctor, etc. Employees’ death or illness incurred as a result of overwork, you would be held liable for damages with a great compensation to pay.

If you plan on asking them to work overtime sometimes, it needs to be stipulated in a labor and management agreement, that you will then notify the Labor Standard Inspection Bureau of. Any work done overtime without said agreement will be a violation of Labor Standards.

2) Wages Calculation

Once you have their total working hours in hand, you need to calculate your employee’s salary. Mistakes in their salary will affect your employee’s trust in you so you want to be careful. Below is an example of a pay slip that calculates an employee’s salary.

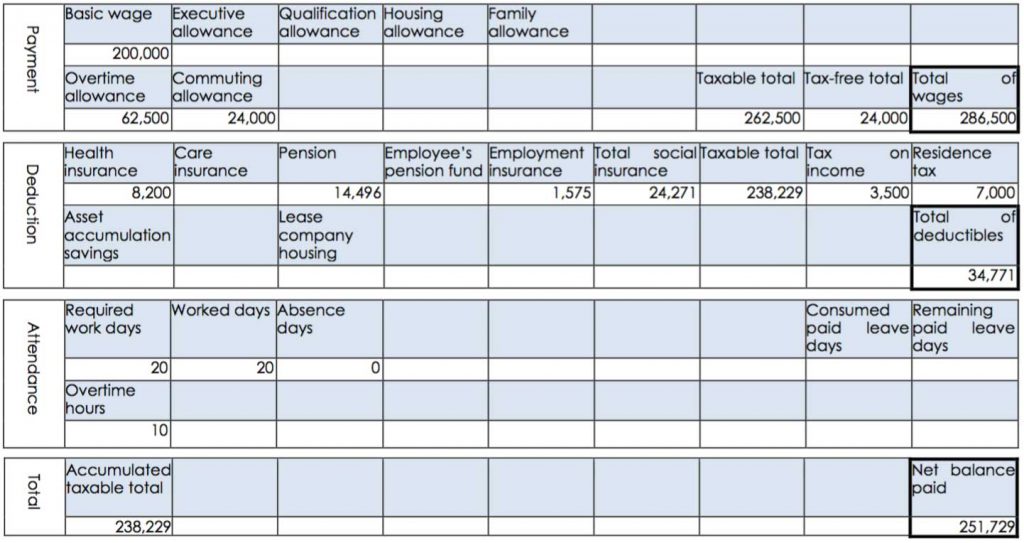

< Payment Slip (Image)>

In a simple break down, a pay slip should show the total payment and the total deduction.

| Payment amount |

| This is the salary total. To calculate it, overtime allowance, commuting allowance and other extra allowance are added to the basic wage. |

| Deduction amount |

| This is the amount of money deducted from the payment by the company to cover labor or social insurance fees. For example, in the case of health insurance/care insurance、「Standard Monthly Remuneration」「Worksite location 」 and 「employee age」 determine the amount of the fee. For the income tax, it will depend on factors like the「amount of payment after paying social insurance」「number of dependents」. Other fees such as rental fee if the employee is renting a house provided by the company are also applicable. |

Estimating wages is not just about calculating working hours, but also determining the correct amount to be paid according to the rules on tax payments and social insurances fees

3) Mandatory annual notifications

Employees who have joined labor insurance, or social insurance are required every year to submit at least these notifications.

| Before July 10th of every year | Declaration of final insurance premiums( labor insurance)、Notification of base amount for calculation of social insurance |

Additionally, you will need to submit notifications in case of events or changes, if deemed necessary by the country’s regulations such as notice of payment of bonus when bonus are paid, or notice of change of monthly wage if it has changed after establishment. (Both of these affect social insurance)

日本語

日本語 中文

中文