Startup loan programs

1) Public loan programs

There are a number of programs through which public institutions or governmental banks can provide financial assistance to new startups. Foreign nationals are just as eligible for them as Japanese nationals, even though in case the duration of stay has not been long enough yet for the foreigners, the screening is slightly tougher. On top of that, the establishment plan has to be written in Japanese following a predetermined format, so a considerable knowledge of Japanese language is needed. For most foreigners however, they usually gather the necessary establishment funds on their own.

Below are the main existing loan programs

| Program | Startup Assistance Loan Security Program | New Startup Loan Program |

| Use of funds | Equipment fund・Operating fund | Equipment Fund・Operating Fund |

| Loan limit | \25,000,000 | \30,000,000

(of which15,000,000 for operating fund) |

| Repayment deadline | Operating fund: within 7 years

Equipment fund: within 10 years |

Operating fund: within 5 years

Equipment fund: within 15 years |

| Guarantor・Collateral | In case of a company, the representative should be the guarantor | Not necessary in principle |

| Support Desk | The Japan Chamber of Commerce and Industry

Small and Medium Enterprises Support Desk TEL: 03-3283-7700 |

Japan Finance Corporation and National Life Finance Corporation

Business funds desk consultation desk TEL: 0120-154-505 |

※These are programs run in 2015. For ongoing programs, check the latest updates.

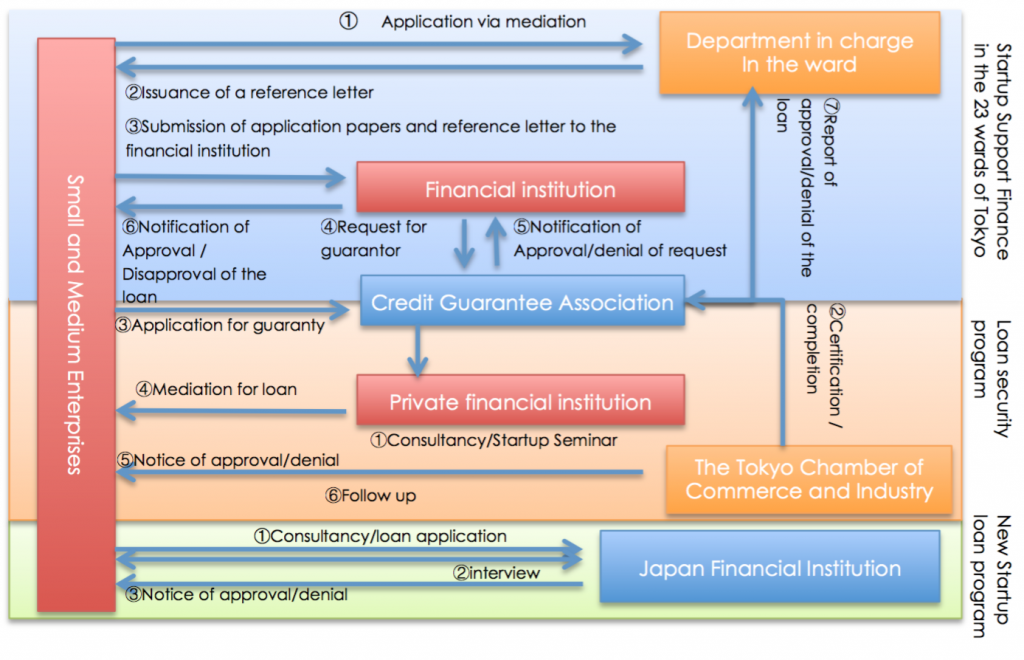

2) Relation between a loan program and the institution in charge of it

3) Screening for foreign nationals/foreign enterprises applications.

Although, foreigners and foreign corporations have equal opportunities to these loans as Japanese nationals and Japanese enterprises, there are some screening criteria specific to them.

| Status of Residence | To be a holder of a residence card that allows business activities within Japan. |

| Continuity of business | Residence historic/Business historic in Japan, spouse nationality, ownership of a real estate are all attentively looked at to judge the applicant stability and make the decision. |

| Joint-stock corporations, limited liability corporations with foreign representative can apply, but branch offices are not eligible. | |

Subsidies program

Across the country and the city of Tokyo, there are few grant programs for startups.

| Program | Subsidy program for startups | Subsidy program to generate innovation in the use of regional resources |

| Eligible applicant | Individual establishing a new business or a second one、individuals seeking advices from registered professional advisory institutions for the SME | SME founder or aspiring founder |

| Costs eligible for the subsidy | Contract fees for the advisory body, Advertisement fees, funds needed for establishment and launching of operations | Development of products/services, and the fees necessary to create new demands |

| Amount of the subsidy | Up to 2 million yen subsidy rate 2/3 | Up to 8 million yen Subsidy rate 1/2 |

| Support Desk | Subsidy program for startups Tokyo office

TEL 03-3524-4668 |

Tokyo Metropolitan Small Business Promotion Agency |

※Those are programs executed in 2015. For ongoing programs, check the latest updates.

日本語

日本語 中文

中文